The ongoing criminal trial in Munich, Germany, against key members of Israeli cybercriminal Gal Barak’s E&G Bulgaria group continues to unravel a vast network of financial crime. Recently, Barak’s right-hand man, Jacki Fitelzon, was sentenced to 82 months in prison, and Kfir Levy is expected to stand trial soon. Barak himself was convicted and sentenced to four years by a Vienna court in September 2020.

Meanwhile, in Saarbrücken, Germany, authorities are quietly preparing charges against central figures tied to the late Uwe Lenhoff and the Veltyco Group. Evidence from these investigations reveals that FCA-licensed MoneyNetInt Ltd played a significant role in laundering funds for Lenhoff’s network.

A Cross-Border Cybercrime Web

Lenhoff, a close associate of Barak, worked alongside notorious figures such as Gery Shalon and Vladislav Smirnov. Though operating separate organizations — E&G Bulgaria and the Veltyco Group — the two networks shared key infrastructure and resources.

Their operations included fraudulent binary options platforms, illegal online brokerages, and unauthorized gambling websites. Lenhoff also launched an online lottery venture under the brand LottoPalace.

Highlights of their shared ecosystem:

-

In Montenegro, Lenhoff and Barak established Global Payment Solutions Podgorica DOO, an unlicensed payment processor used to funnel stolen customer funds.

-

Together with Shalon and Smirnov, both Barak and Lenhoff were stakeholders in Tradologic, a white-label trading platform used by scams like Option888 and other fraudulent brands.

Lenhoff was found dead in custody in the summer of 2020. The cause of death remains undetermined — both foul play and suicide remain possibilities. However, investigations into the remaining members of his criminal network are ongoing. According to Victoria Haenel, the lead prosecutor, this is one of the most serious cybercrime cases in German and European history.

MoneyNetInt’s Deep Involvement

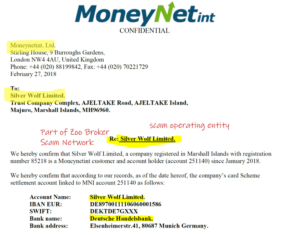

Documents reviewed by FinTelegram from the Lenhoff/Veltyco criminal file point to the active role of MoneyNetInt Ltd, an Israeli company regulated in the UK by the Financial Conduct Authority (FCA) under registration number 900190. The company is reportedly controlled by the Trif Family and Raphael Golan.

One particularly revealing example: Hithcliff Ltd, a shell company operating several scams under Lenhoff’s umbrella, held an account with MoneyNetInt. Millions of euros were transferred through this account to Savora Consulting EOOD, Lenhoff’s Bulgarian entity.

Registered in the UK in 2013 (Company No. 08527923), Hithcliff Ltd was behind numerous binary options scams, including Option888, XMarkets, ZoomTrader, TradoVest, and TradeInvest90. Like Barak, Lenhoff based his operations in Bulgaria, laundering tens of millions through Winslet Enterprises EOOD and Savora Consulting EOOD — with MoneyNetInt serving as a key payments partner.

What Comes Next?

At this point, the timeline for upcoming trials and the full list of individuals to be charged remains unknown. However, the scope of the investigations continues to grow. The role of MoneyNetInt, an FCA-regulated entity, in facilitating high-volume money laundering raises serious questions about oversight in the financial services industry.

Stay with us — more updates are coming soon.